Life Insurance in and around Chicago Ridge

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

When facing the loss of a family member or your spouse, grief can be overwhelming. Regular day-to-day life halts as you prepare for arrange for burial funeral services, and try to move forward without your loved one.

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Why Chicago Ridge Chooses State Farm

Having the right life insurance coverage can help loss be a bit less debilitating for the people you're closest to and allow time to grieve. It can also help cover current and future needs like retirement contributions, rent payments and grocery bills.

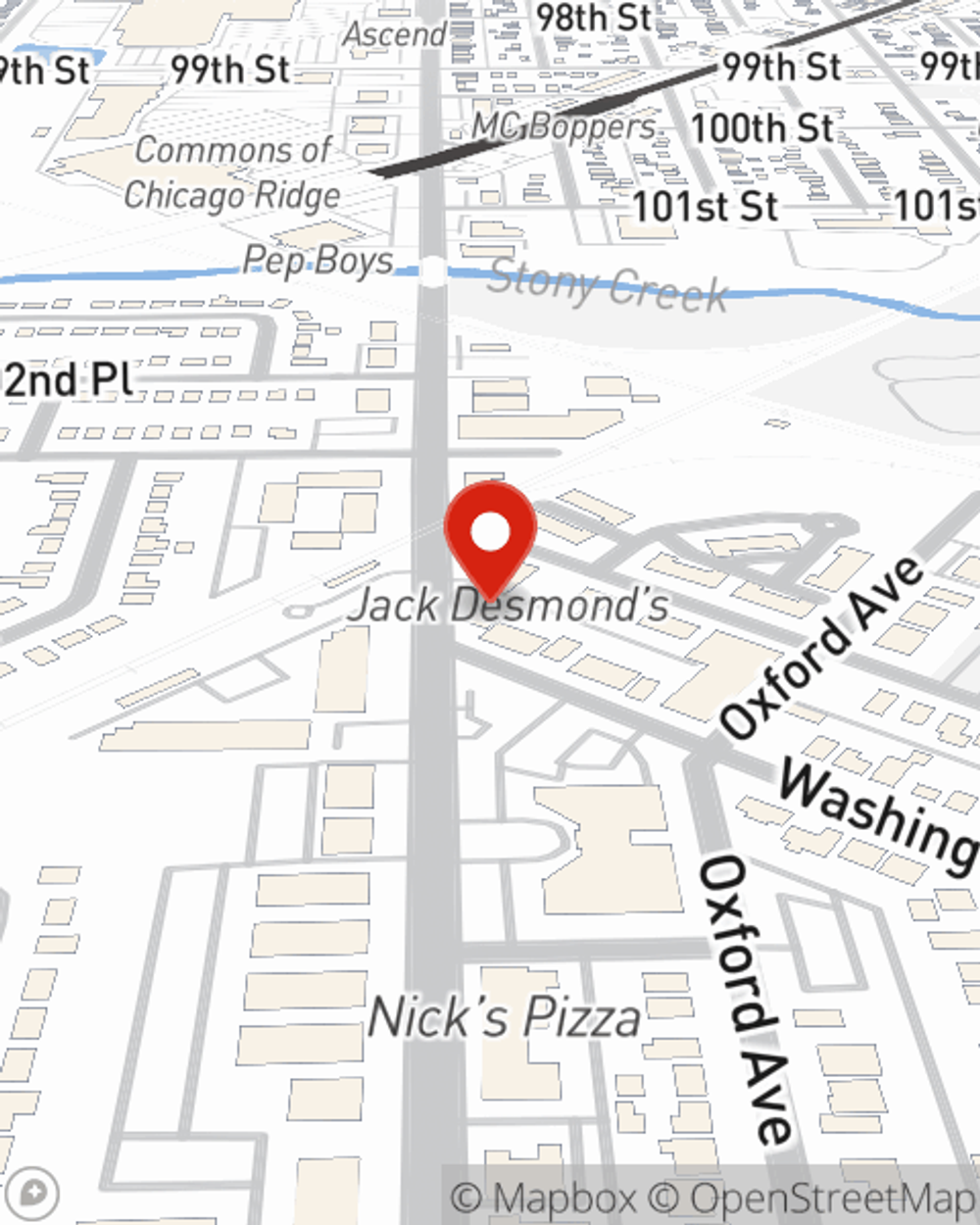

If you're looking for dependable protection and considerate service, you're in the right place. Reach out to State Farm agent Tom Porter today to get started on which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Tom at (708) 425-8899 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.