Business Insurance in and around Chicago Ridge

Calling all small business owners of Chicago Ridge!

Helping insure small businesses since 1935

Help Prepare Your Business For The Unexpected.

Whether you own a an art gallery, a home cleaning service, or a fabric store, State Farm has small business coverage that can help. That way, amid all the different decisions and moving pieces, you can focus on your next steps.

Calling all small business owners of Chicago Ridge!

Helping insure small businesses since 1935

Strictly Business With State Farm

Your business thrives off your tenacity creativity, and having great coverage with State Farm. While you support your customers and put in the work, let State Farm do their part in supporting you with business owners policies, worker’s compensation and commercial auto policies.

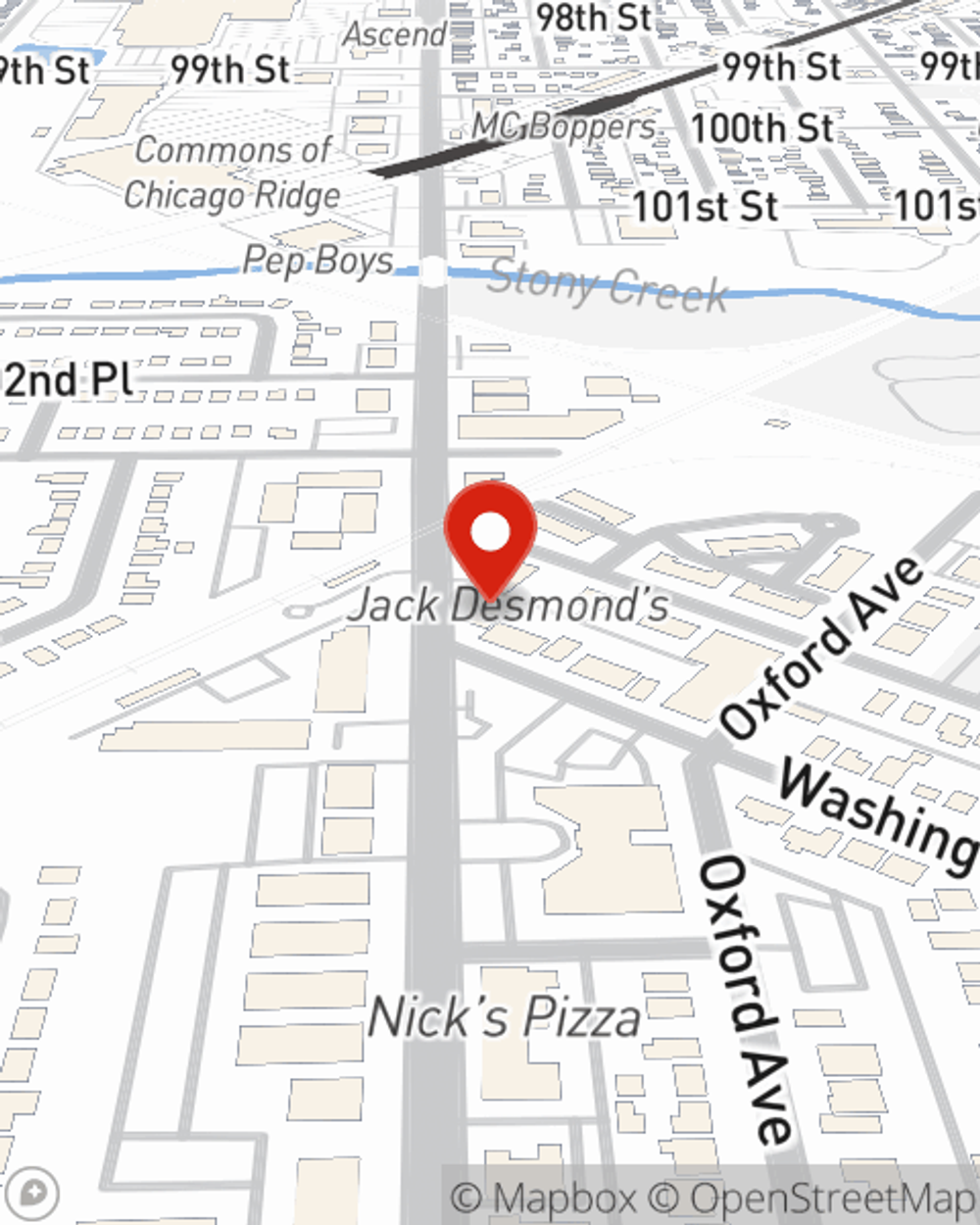

Since 1935, State Farm has helped small businesses manage risk. Visit agent Tom Porter's team to discover the options specifically available to you!

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Tom Porter

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.