Auto Insurance in and around Chicago Ridge

Auto owners in the Chicago Ridge area, State Farm can help with your insurance needs.

Take a drive, safely

Would you like to create a personalized auto quote?

Be Ready For The Unexpected

State Farm isn't afraid of the unexpected, and with our fantastic coverage, you don't have to be either. With multiple options for coverage and savings, you can be sure to choose a policy that fits your individual needs.

Auto owners in the Chicago Ridge area, State Farm can help with your insurance needs.

Take a drive, safely

Great Coverage For Every Insurable Vehicle

With State Farm, get revved up for wonderful auto coverage and savings options like medical payments coverage car rental and travel expenses coverage, the good driver discount a newer vehicle safety features discount, and more!

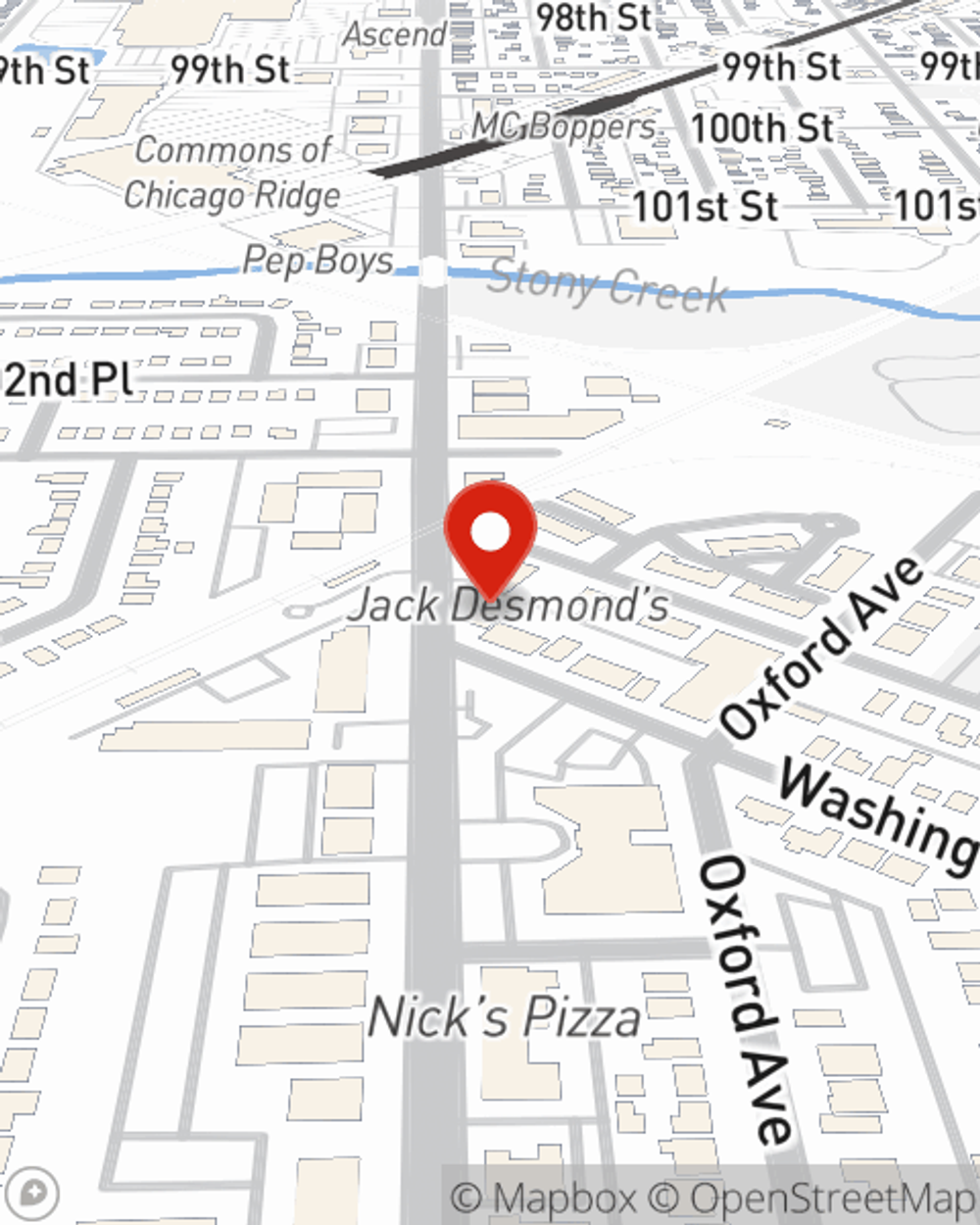

Visit agent Tom Porter's office to discover how you can benefit from State Farm's auto insurance.

Have More Questions About Auto Insurance?

Call Tom at (708) 425-8899 or visit our FAQ page.

Simple Insights®

How to prevent car theft

How to prevent car theft

Tips to help prevent car theft and auto break-ins, including car alarm, VIN etching, smart keys and more.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Simple Insights®

How to prevent car theft

How to prevent car theft

Tips to help prevent car theft and auto break-ins, including car alarm, VIN etching, smart keys and more.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.